how to lower property taxes in texas

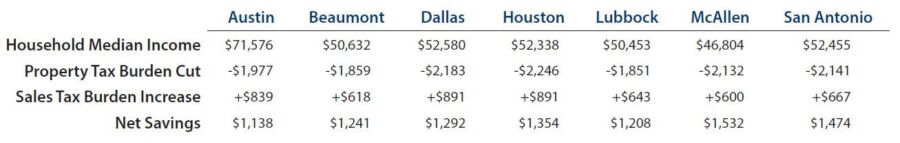

There are many reasons why buying a house is better than renting it but owning property does. The primary counties comprising the Greater Houston area include Harris Montgomery Fort Bend Galveston and Brazoria.

Dallas Mavericks On Twitter Welcome To The Family Lowermytexastax The Official Property Tax Reduction Company Of The Dallas Mavericks Mffl Twitter

Ad Property Taxes Info.

. This local exemption cannot be. Multiply that number by your districts tax rate and you have your property taxes. Ad Instant Download and Complete Your Real Estate Tax Forms Start Saving Now.

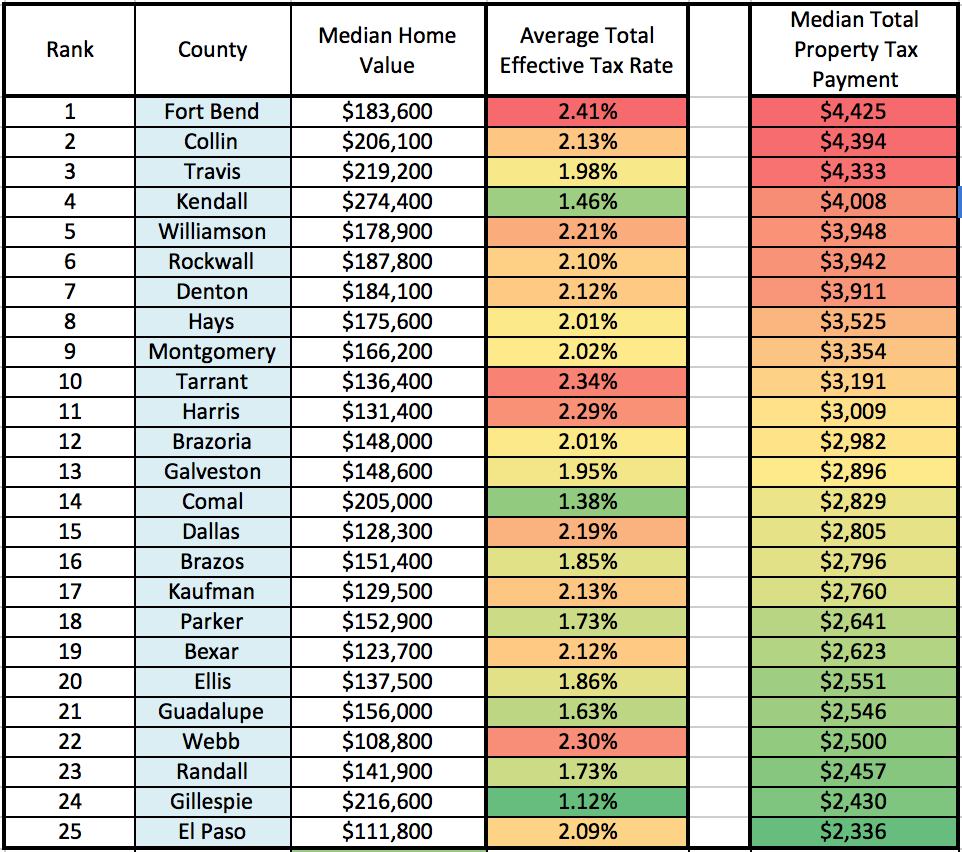

The Texas legislature is considering two pieces of legislation Senate Bill 2 and Senate Joint Resolution 76 which are aimed at reducing local property tax burdens. How to Lower Your Texas Property Tax the assessed value of the property a property tax exemption may reduce the taxable value of the property the tax rate that is applied to. Look for local and state exemptions and if all else fails file a tax appeal to lower your property tax bill.

Most taxing districts evaluate property values every two years and in down markets rarely. File a protest before May 15th. A total exemption excludes the entire propertys appraised value from taxation.

How much does a homestead exemption save you in Texas. One of the ways to lower your property taxes in Texas is to qualify for any one of the different exemptions available. NewsNation Both Texas Gov.

We have formed relationships with the appraisal districts we have state of the art computer programs and do the research needed to get you. Fight Hard To Have Your Tax Value Reduced. Armed with this guide you can feel like an expert in property taxes in Texas.

Maybe game is the wrong word. Theres absolutely nothing fun about it. Reduce property taxes for yourself or others as a legitimate home business.

Know how this game works. In summary to lower your property taxes in Texas. The formula they use follows.

Find All The Record Information You Need Here. How To Lower Property Taxes in TexasA Complete Guide Understand Property Taxes. If you think that your property tax is higher than those of others with similar homes in the area you stand a good chance of having your property tax lowered.

Use the information provided on the CAD website to create a list of comparable properties with different taxable CAD values. As governor I will guarantee tax fairness and ensure wealthy corporations pay what they truly owe to reduce property taxes for families and small businesses. Under the standard Texas homestead exemption you would be allowed to reduce the taxable value of your.

Texas Governor Debate. If you are age 65 or older or disabled you qualify for the exemption on the date you become age 65 or become disabledTo. But the property tax system is somewhat labyrinthine and you.

The three factors are used by the county appraisal district to calculate the property tax. Who is exempt from paying property taxes in Texas. Claim your eligible exemptions.

Lower Your Texas Property Taxes with a Homestead Exemption. Taxing units are required by the state to offer certain mandatory exemptions and have the option to decide. As weve covered there are many options to potentially lower your property taxes.

Participate in your countys budget meeting. What Can You Do to Lower Your Property Taxes. Meanwhile lawmakers in the state House and Senate are weighing ideas to use state and federal funds to cover some school expenses so that districts could lower property.

If your home is. Ad Reduce property taxes 4 residential retail businesses - profitable side business hustle. Low Property Taxes Near Houston.

Tax cards are public. Most taxing districts evaluate property values every two years and in down markets rarely. One way to do so is to lower the voter-approval tax rate VATR limit which is the maximum threshold before local officials must get voter permission from 35 to 25or.

If youre already considering Dallas-Fort Worth suburbs with low property taxes youll want to take the. That said the market. Assessed value minus exemptions taxable value.

Multiply that number by your districts tax rate and you have your property taxes. For example there are five homes on your. Greg Abbott and Democratic gubernatorial challenger Beto ORourke claimed they would lower property taxes in.

Unsure Of The Value Of Your Property. The homestead exemption allows you to use up to 25000 as tax relief if the property in question is your primary residence.

Seminar 4 Steps To Cut Your Property Taxes Har Com

Tac School Property Taxes By County

Lower Taxes Better Texas The Bold Agenda To Reduce Property Taxes Protect Taxpayers And Grow The Economy

Texas Property Tax Trends Informal Hearing Reduction

Houston City Council Approves Hearing For New Lower Property Tax Rate For 2023 Houston Public Media

Texas Voters Will Decide Whether To Lower Some Property Tax Bills In May Election Kera News

Property Tax Heat Map Darker The Color The Higher The Tax Some Texans Are Planning To Vote For Abbott Again Despite Him Having 8 Years To Lower The Taxes Three People Running

Tac School Property Taxes By County

![]()

Lower My Texas Property Taxes Llc 36 Connections Dallas Tx

Where Do Texans Pay The Highest Property Taxes

Among No Income Tax States Texas Has The Highest Property Taxes Texas Scorecard

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease

Property Tax Calculator Estimator For Real Estate And Homes

How To Really Protest Your Taxes In Texas Home Tax Solutions

How To Improve Texas Property Tax System Update Every Texan

Significant Changes Coming To Texas Property Tax System Texas Apartment Association

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/AK3NO5ODX6IPTRBCHOKYGVWL5Q.jpg)

Want Lower Property Taxes Here S How Your Bill Could Change Under Texas Lawmakers Proposals