salt tax deduction explained

The salt tax originated in China in 300BC and became the main source of financing the Great Wall As a result of the successful profitability. The deduction also incentivized states to tax their residents more progressively since the SALT deduction applies to types of taxes that tend to be progressive like taxes on income.

Itemized Deduction Who Benefits From Itemized Deductions

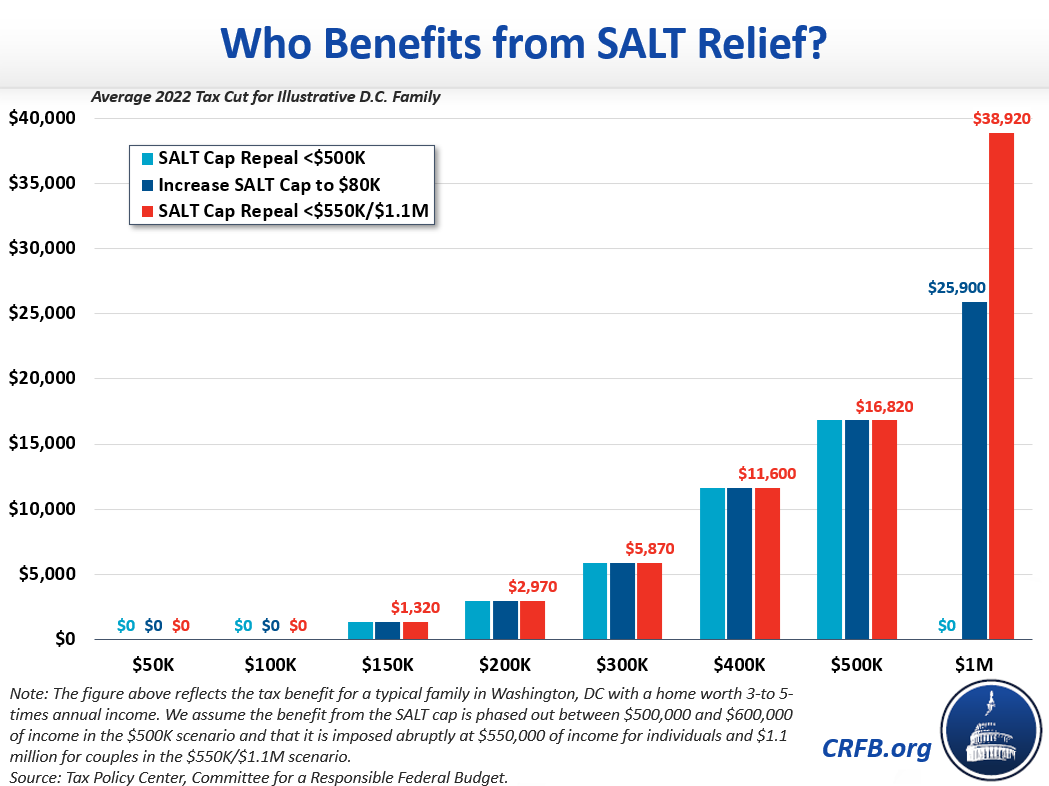

But instead of lifting the cap for all taxpayers under the proposed legislation the deduction would start at 60000 for those making over 400000.

. The SALT deduction also generally benefits states that have relatively large numbers of high-income taxpayers and high-tax environments. For anyone that itemizes their personal deductions they can deduct 10000 with the SALT deduction or 5000 for married people filing separately. A salt tax refers to the direct taxation of salt usually levied proportionately to the volume of salt purchased.

164 b 6 as added by the Tax Cuts and Jobs Act TCJA. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes. The acronym SALT stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to taxpayers who itemize their deductions.

It allows those in high-tax states to deduct the money they spend on local and state taxes. In New York the deduction was worth 94 percent of AGI while the average across all states and the District of Columbia was 46 percent. WASHINGTON The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local tax SALT deduction is in effect.

Indeed research suggests that the SALT deduction is associated with increased revenues from state and local sources. Representatives looking to adjust the deduction cap. 52 rows The state and local tax deduction commonly called the SALT.

The taxation of salt dates as far back as 300BC as salt has been a valuable good used for gifts and religious offerings since 6050BC. Theoretically state and local governments could then use. The change may be significant for filers who itemize deductions in high-tax states and.

The Tax Policy Center says that the SALT deduction provides an indirect federal subsidy to state and local governments by decreasing the net. 115-97 12222017 and the amounts that are excepted from the general disallowance of expenses in connection. The pre-cap SALT deduction allowed people to deduct some state and local taxes to offset federal tax payment effectively subsidizing state and local taxes for taxpayers.

What is the state and local tax deduction SALT. According to an explanation from the Tax Foundation SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. In a Program Manager Technical Advice PMTA IRS has explained the interplay between the 10000 limitation on state and local taxes SALT deduction provided in Code Sec.

House Democrats spending package raises the SALT deduction limit to 80000 through 2030. In Revenue Ruling 2019-11 PDF posted today on IRSgov the IRS provided four examples illustrating how the long-standing tax benefit rule interacts with the. Deductible taxes include state and.

Capping the deduction in 2017 reduced the benefit for people who. Today SALT remains a topic of conversation among taxpayers financial advisors and US. The deduction went into effect during the 2019 tax year and included a cap of 10000.

Under the SALT Act people making less than 400000 would once again be permitted to deduct all state and local taxes on their federal income tax returns provided they itemize their deductions. Just six statesCalifornia New York New Jersey Illinois Texas and.

Pin By Osman Erzincan 1 On Bahcemiz Beautiful Backyards Landscape Design Backyard Landscaping

State And Local Tax Salt Deduction Salt Deduction Taxedu

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Capital Gains Tax On Real Estate 4 Common Misconceptions Money Matters Trulia Blog Capital Gains Tax Capital Gain Real Estate

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

What Is The Salt Deduction H R Block

Salt Deduction Resources Committee For A Responsible Federal Budget

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget